Import quotas are usually tariff free. Import quotas tend to lead to all of the following excepta.

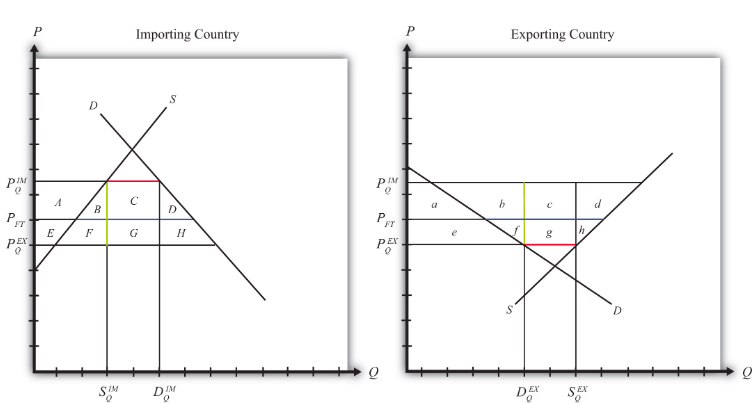

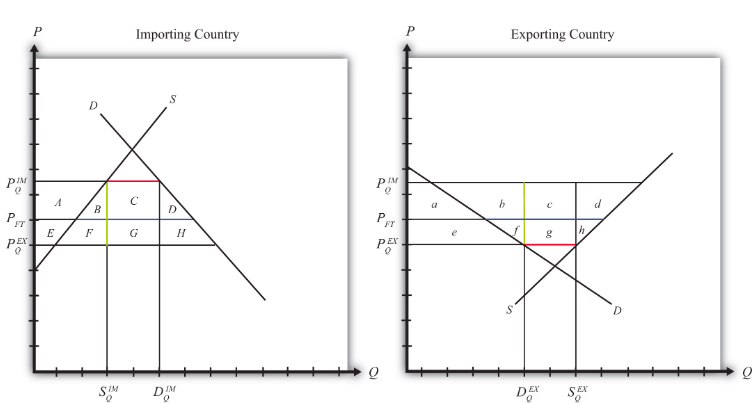

7 12 Import Quota Large Country Welfare Effects Social Sci Libretexts

The main purpose of such quotas lies in decreasing imports while simultaneously boosting a countrys own inherent domestic production.

. However some economists believe that the best solution to the problem of tariffs and quotas is to get rid of them both. Quotas Quotas Quotas a form of trade barrier are limits on the quantity of a commodity that can be imported or exported. Its only when the quota is used up tariffs are starting to be levied on what follows after.

For example the United States imposes an import quota on cars from Japan. An example of a trade barrier where the quantity imported of a particular good is restricted. Take for example the United States which continues to maintain a TRQ for sugar with an in-quota specific.

It places a physical limited on the quantity of good that may be imported of a certain period of time which will restrict foreign imports to the domestic market and increase domestic price ceteris paribus. Domestic consumers of the imported good being harmedc. Answer 1 of 4.

To increase the gross domestic product. A good example is the tariff free quota of lamb exports that UK negotiated for its cousins in New Zealand after they. The Japanese government may see fit to impose a quota.

Meanwhile quotas limit the quantity of goods imported. Which of the following best states the purpose of an import quota. Prices falling in the exporting country.

Tariff limits imports by increasing the price of imported goods. A university website that tells the success stories of people who have graduated from th. Which option is the best example of a text with an agenda.

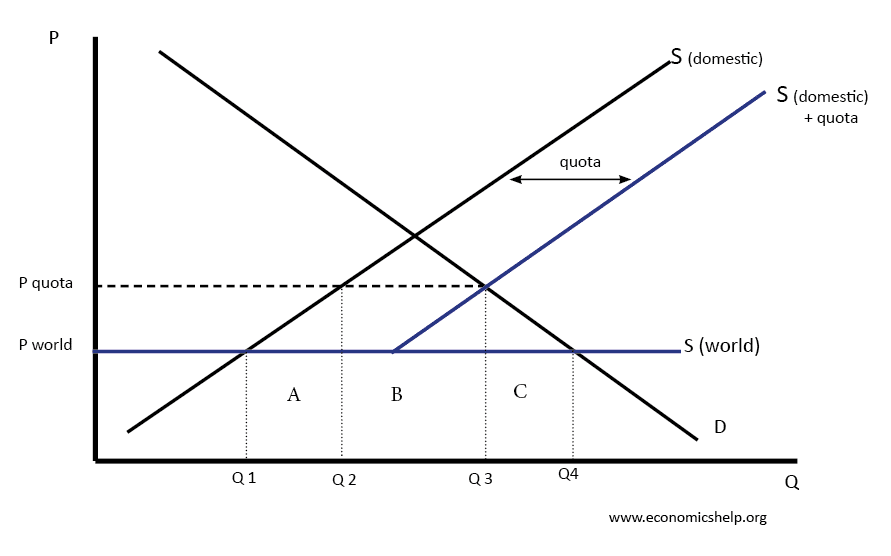

Quotas are announced in specific legislation or may be provided for in the Harmonized Tariff Schedule of the United States HTSUS. The Tariff vs. Quota on a diagram.

These are referred to as tariff rate quotas TRQs. For these reasons tariffs are generally considered to be preferable to import quotas. Absolute quotas strictly limit the quantity of goods that may enter the commerce of the United States for a specific period.

Import quotas are numerical restrictions which a government of one country imposes on the imports of another competing nation. A It affords protection to the producers of raw materials. With the numbers of such imports restricted the price of these imports will increase.

To prevent a budget deficit. This system of import quota has the following merits. Which of the following best states the purpose of an import quota.

Different between import tariffs and import quotas. Absolute and tariff rate. No I think you misunderstand.

Domestic producers of the imported good being harmed b. The United States imports many different types of goods f Exports Exports are any goods and services that are sold to. 3 COSTS AND BENEFITS OF IMPORT QUOTAS al 2015 assert that it is a main customer of particularly steel glass as well as different other equipment along with aluminium derived prime problems that in turn influenced the overall economy of the United States.

C It induces the domestic processing of semi-finished goods. Import quotas control the amount or volume of various commodities that can be imported into the United States during a specified period of time. Quotas are announced in specific legislation or may be provided for in the Harmonized Tariff Schedule of the United States.

To increase the gross domestic product. United States import quotas may be divided into two types. Quotas like other trade restrictions are typically used to benefit the producers of a good in that economy.

Prices increasing in the importing country d. Say if the government sets a 10 tariff the price of imported goods will increase by 10 than the original price when they enter the domestic market. To prevent a budget deficit.

Import quotas limit the amount of Imports Imports are any foreign-made goods and services that are brought into a country to be sold. Import quotasdefined as a limit on the number of units of a product that may enter a countryare generally forbidden under the original GATT through Article XI. In particular Ford as well as Chrysler registered the lowest sales since the period 1961.

To lower taxes and limit government spending. To reduce competition from foreign producers. The quota share is a specified number or percentage of the allotment as a whole quota that is prescribed to each individual entity.

This isnt the view of most Americans or apparently of a majority of members of Congress but it is. To reduce competition from foreign producers. B It saves the valuable and scarce foreign exchange resources of the country.

Quotas are established by legislation Presidential Proclamations or Executive Orders.

Import Quota Types Purposes Methods Pros And Cons Penpoin

Quotas Versus Tariffs Hinrich Foundation

/TariffsAffectPrices1_2-e3858c9eddb649a8b3ffc70af1f9938b.png)

0 Comments